“Back mountain federal credit union offers a variety of loans

for all aspects of your life. ”

for all aspects of your life. ”

Get In Touch

ph. (570) 696-1633 : fax (570) 696-1643

Location

1501 Memorial Highway

Shavertown, PA 18708

backmtnfcu@gmail.com

Hours

Mon:8am – 4pm

Tue: 8am – 4pm

Wed: 8am – 4pm

Thur: 8am – 4pm

Fri: 8am – 4pm

Sat: Closed

Sun: Closed

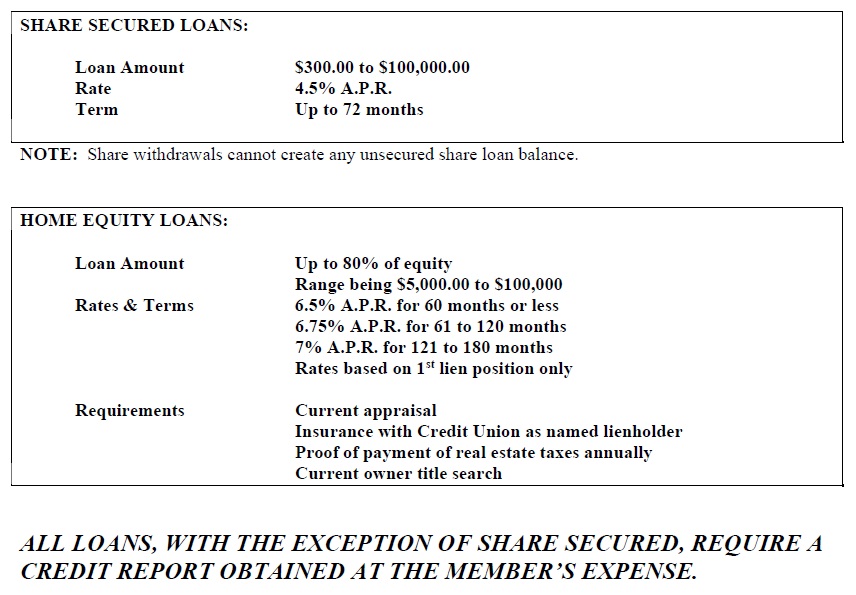

HOME EQUITY LOAN SPECIAL

Use the equity in your home to do those home repairs , to consolidate your credit card debt, or even to get that pool you have been dreaming of!

Borrow up to 80% of the equity in your home.

$ 10,000.00 to $ 50,000 @ 6% for up to 10 years

This special is for 1st lien position only.

Borrower responsible for cost of appraisal only.

Credit union will pay all other closing fees.This offer good through May 31, 2024!